I've been cautiously watching the market over the past several weeks reading up on various stocks as there always seems to be at a least a handful appealing valuations hiding in plain sight. One franchise that has caught my attention in recent weeks has been DOW Inc. (DOW). This company was recently spun off from DowDupont (DWDP) conglomerate that merged a few years back which disclosed the intent of eventually dividing the combined company into three separate publicly traded companies. The material science division of DowDupont was the first to be spun-off, effective April 1, 2019, and is now known as the "new" DOW Inc. See below for details of the purchase along with some additional metrics and information obtained from the 2018 investor day.

Company Profile: Dow Inc. provides various materials science solutions for consumer care, infrastructure, and packaging markets worldwide. Its Performance Materials and Coatings segment offers architectural paints and coatings, and industrial coatings that are used in maintenance and protective industries, wood, metal packaging, traffic markings, thermal paper, and leather; performance monomers and silicones; standalone silicones; and home and personal care solutions. The company’s Industrial Intermediates & Infrastructure segment offers ethylene oxides, propylene oxide, propylene glycol and polyether polyols, aromatic isocyanates and polyurethane systems, coatings, adhesives, sealants, elastomers, and composites. This segment also provides caustic soda, and ethylene dichloride and vinyl chloride monomers; and cellulose ethers, redispersible latex powders, silicones, and acrylic emulsions. Its Packaging & Specialty Plastics segment provides ethylene, and propylene and aromatic products; and polyolefin elastomers and ethylene propylene diene monomer rubbers. The company was formerly known as Dow Holdings Inc. Dow Inc. is based in Midland, Michigan.

Purchased: 42 shares x $48.45 = $2,034.90 (+$4.95 commission)

Dividend Income: This purchase adds $117.60 of income annually ($2.80 annual dividend; paid quarterly in Mar, Jun, Sep, and Dec)

Forward P/E ratio: 10.98 vs. S&P Forward P/E @ 16.98

Debt to Capital < 50%: Yes, 47.68%

Interest Coverage ratio of at least 3:1: Yes, 5.15x

S&P and/or Moody's credit rating of BBB+/Baa1 or better: No, BBB/Baa2

Current dividend yield > 1.5x S&P yield: Yes. 5.8% vs. S&P's 1.96%

Payout Ratio < 60% (or < 85% for utilities): No, 63%

Dividend King or CCC classification: N/A, new company and DWDP had quarterly dividend rate that was frozen from November 2017 thru March 2019.

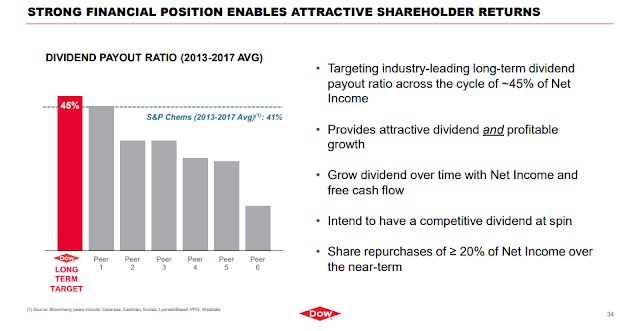

Comments: I've spent some time over the past week reviewing the company's financials and looking through the investor day presentation that the company put together before the spin-off and can be seen here. I am convinced that there is sufficient value here relative to the price paid for a small piece of ownership in this franchise. The company's products are used all over the world and they play an important part of the supply chain for many companies and I am confident DOW will remain a going concern and long while to come. If management can execute their plan which outlines a disciplined capital allocation approach to maximize shareholder returns, my return on investment should be more than sufficient over the long run. Below are a few of the slides from the aforementioned presentation.

No comments:

Post a Comment